Protect Your Legacy.

Family Bank Trusts – (aka SLATs)

*You must act before the New Year*

As you may know, the 2024 lifetime estate and gift tax exemption is $13,610,000 per individual, which permits married couples to combine their exemptions to transfer up to $27,220,000 estate tax-free. Any portion of an individual’s estate in excess of the exemption amount at death will be subject to a 40% estate tax. The exemption amount was established by the 2017 Tax Cuts and Jobs Act (TCJA).

For clients with a net worth (or anticipated net worth) in a range near or over the reduced exemption amount, it is prudent to consider implementing various estate planning techniques to transfer assets outside of the estate to avoid estate taxes. Many planning techniques involve the creation of an irrevocable trust that is considered a separate entity from the estate. For a trust to be excluded from a trustmakers (person who establishes and funds the trust) estate, the trustmaker cannot be a beneficiary of the trust.

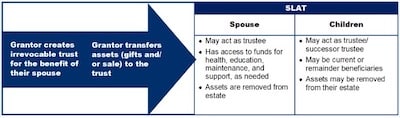

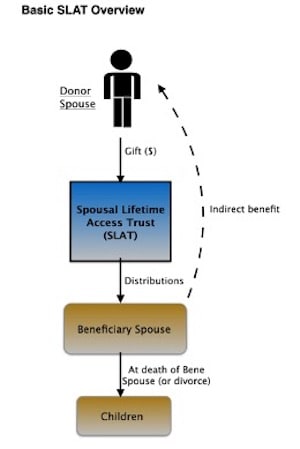

For trustmakers that may require their assets to supplement their standard of living, transferring assets to an entity that eliminates their ability to utilize the assets can stop the planning process before it even begins. If, however, a trust is established by someone else for the benefit of a person, then the assets are not included in that person’s estate, and they can receive distributions from the trust. Family Bank Trusts (aka SLATs) are precisely this type of structure. It allows a person to establish an irrevocable trust for their spouse or children as the beneficiary and provides the family access to the assets. This removes the asset from both the person and their spouses’ estate. Not only can the spouse or children be a lifetime beneficiary, but they can also be the trustee, providing them with management and distribution authority. In addition, as with any properly created irrevocable trust, the assets in the trust may be afforded asset protection from creditors.

While each spouse may create a trust for the other, it is important that the trusts are not perceived to be tax-avoidance vehicles created pursuant to an agreement and in exchange of the other. Attempts to establish reciprocal trusts will be “uncrossed” by the IRS and treated as though each person created a trust for his/her own benefit. Some factors that contribute to a finding of reciprocal trusts include: if the trusts are identical in substance, are executed closely in time, or are funded with the same (or similar) assets in equal quantities.

Individuals considering the use of a Family Bank Trust should fully comprehend the ramifications of their spouse being the beneficiary of the trust. If there is a divorce or if the spouse passes away, access to the trust will cease. An analysis of the individual’s future cash flow should be conducted to ensure the ability to provide for a continued standard of living should one of these situations occur.

Ultimately, Family Bank Trusts offer married couples and families with possible estate tax liabilities the ability to transfer assets outside of their estates while providing peace of mind that the assets continue to be available to maintain their standard of living, if needed.

Contact the attorneys at Sowards Law Firm to help set up your Family Bank Trust at (408) 371-6000 or info@SowardsLawFirm.com.